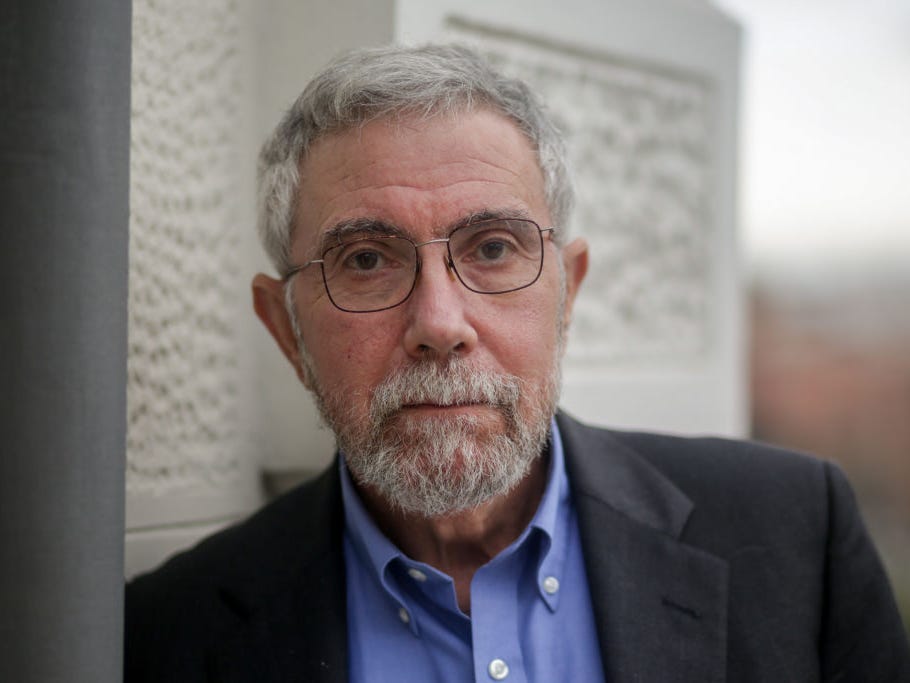

Ricardo Rubio/Europa Press/Getty Images

- The reopening economy is seeing stronger inflation, which many expect to be temporary, including famous economist Paul Krugman.

- The Nobel laureate told Insider that watching several indices gives a clearer picture than the Fed's top measure.

- Anecdotal evidence and workers' contracts can also catch some price growth missed by other data, he said.

- See more stories on Insider's business page.

As comes the recovery, so does inflation.

The gradual reopening of the US economy is quickly lifting consumer demand as Americans rush to revive their pre-pandemic habits. The surge in spending has already pushed popular gauges of inflation higher, but experts see price growth accelerating further as the recovery continues.

Debates over how inflation trends over the next year split economists into two camps. One group – which includes Republicans and even moderate Democrats like former Treasury Secretary Larry Summers – fears the latest stimulus package and strong demand will spark rampant and dangerous price growth. The other sees higher inflation fading as the economy settles into a new sense of normal.

Nobel prize-winning economist Paul Krugman sits squarely in the latter group, but he told Insider he's still keeping an eye out for a potential inflation shock.

"Both sides are predicting the stuff that we're seeing now," he told Insider. "Anyone who wasn't expecting to see some prices of some things rise as the economy came roaring out of the pandemic wasn't paying attention," he said.

It's too early to say whether either side of the inflation debate is right, he said. Bottlenecks and supply-chain issues are behind some rising inflation gauges, but it remains to be seen whether those effects subside or give way to broad and concerning price growth.

Krugman said he's watching a handful of indicators to determine whether inflation poses a significant risk to the recovery. Core inflation isn't enough, since various bottlenecks could elude the benchmark, he said. Instead, the inflation-metric dashboard maintained by the Federal Reserve Bank of Atlanta gives a more holistic view of nationwide price growth.

Sticky inflation indices, which track a subset of goods and services that change price somewhat rarely, are also worth monitoring, he said. Krugman also highlighted trimmed-mean inflation gauges, which exclude large price swings to more accurately track broad inflation trends.

"The whole question is whether prices that are not changing all the time are being set with expectation of inflation in the future, whether we get this leapfrogging process, which is what makes inflation - once embedded in the economy - harder to get rid of," the economist said.

Krugman also backed the use of some less conventional metrics. Wage contracts and union agreements are less easy to track, but data on companywide pay can reveal whether firms are building the expectation of higher inflation into their compensation, he said.

Getting some qualitative data is also worthwhile, the economist added. Surveys show Americans bracing for stronger inflation as the economy bounces back. Such data and other anecdotes can provide some insights into nationwide price growth that indices miss, Krugman said.

"I'm forcing myself to read the Beige Book these days, because I think, in some ways, it's going to be a better guide than the statistics are," he added, referring to the Federal Reserve's periodic report of current economic conditions.